ETH Price Prediction: Breaking the September Curse with Bullish Technicals and Strong Fundamentals

#ETH

- MACD bullish divergence suggests building upward momentum despite current price below moving average

- Significant whale activity and institutional developments provide strong fundamental support

- Negative exchange flux balance and reduced selling pressure create favorable conditions for price appreciation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Pressure

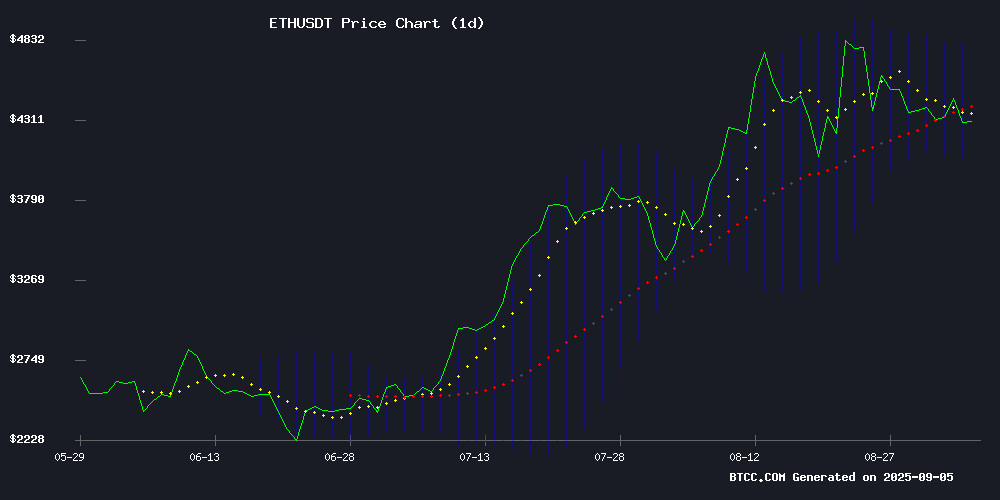

ETH is currently trading at $4,296.15, sitting below its 20-day moving average of $4,430.93, indicating some near-term resistance. However, the MACD reading of 38.65 suggests building bullish momentum, while the Bollinger Bands show support around $4,053.74. According to BTCC financial analyst Robert, 'The technical setup suggests ETH is consolidating within a healthy range, with the MACD positive divergence hinting at potential upward movement if it breaks above the 20-day MA.'

Market Sentiment: Whale Activity and Institutional Developments Support ETH

Recent news highlights significant whale movements, including a $645 million ETH stake and potential $3.6 billion treasury staking on Linea. Stripe's Tempo Blockchain launch and BNB Chain's enhancements reflect growing institutional adoption. BTCC financial analyst Robert notes, 'The combination of whale accumulation and major infrastructure developments creates a fundamentally supportive environment for ETH, though short-term volatility may persist due to seasonal patterns and security concerns.'

Factors Influencing ETH's Price

UK Trader James Wynn Claims Bank Accounts Frozen Without Explanation Amid Debanking Debate

Leveraged trader James Wynn, known for his high-stakes cryptocurrency trades, alleges that his UK bank accounts were abruptly frozen without justification. The trader claims these accounts facilitated millions in tax payments to UK authorities, raising questions about financial censorship.

Wynn's public outcry on social media has reignited discussions around debanking practices in Britain. Banking representatives reportedly cited instructions 'from higher up' but provided no substantive explanation for the account freeze.

The case highlights growing tensions between crypto traders and traditional financial institutions, particularly in jurisdictions with strict financial surveillance regimes. UK regulations permit account freezes based on 'reasonable suspicion' of illicit activity, though Wynn maintains his operations were fully compliant.

Ethereum Price: Will Whales Break the September Curse?

Ethereum faces its historical September slump, a month notorious for crypto market weakness. Since 2016, ETH has averaged a -6.4% return in September, with double-digit drops in 2017 and 2018. Only 2016, 2019, 2023, and 2024 bucked the trend—last year’s 3.2% gain came amid ETF optimism and Fed rate cuts.

Whales may rewrite the script this time. Addresses holding 1,000–100,000 ETH have boosted their stakes by 14% over five months, while exchange reserves dwindle. With unrealized profits high, these accumulations could fuel aggressive dip-buying. At $4,500, near record highs, Ethereum’s fate hinges on whether whale demand outweighs seasonal pressure.

Stripe Launches Tempo Blockchain to Revolutionize Stablecoin Payments

Stripe has unveiled Tempo, a high-performance blockchain developed in partnership with Paradigm, designed to optimize stablecoin transactions for global financial services. The platform targets over 100,000 transactions per second with sub-second finality, addressing scalability gaps in existing networks.

Tempo introduces novel features like gas fee payments in any stablecoin via an integrated AMM and maintains full Ethereum compatibility through its Reth foundation. The blockchain also offers institutional-grade enhancements, including optional privacy layers and compliance tools for regulated deployments.

Early design partners from traditional finance and crypto sectors are already testing integrations, signaling strong industry interest in Stripe's foray into blockchain infrastructure. The move positions Tempo as a potential settlement layer for Stripe's expanding crypto payment services.

Ethereum Whale Activity Surges Amid Price Consolidation

Ethereum trades at $4,381, holding steady above $4,250 after retreating from $4,500. Market uncertainty lingers, but whale activity suggests underlying strength.

Large holders are shifting ETH from Binance to DeFi platforms like Aave for yield farming, signaling long-term conviction rather than profit-taking. Analyst Darkfost notes this redeployment into DeFi ecosystems reflects institutional confidence in Ethereum's fundamentals.

The quiet accumulation by whales during consolidation phases historically precedes upward moves. With robust institutional backing and strategic positioning in DeFi, Ethereum appears to be building momentum for its next leg higher.

Ethereum ICO Whale Awakens, Stakes $645 Million ETH

A dormant Ethereum whale from the 2015 initial coin offering has resurfaced, moving $645 million worth of ETH to a staking service. The entity retains $1.1 billion in ETH, maintaining one of the largest known holdings from Ethereum's genesis period.

Market sentiment remains bullish, with Myriad's prediction market indicating 73% of participants expect ETH to breach $5,000 before 2026. This optimism follows regulatory tailwinds for crypto and institutional inflows into ETH-focused investment products.

Ethereum currently trades near $4,300, a 71% quarterly gain despite recent minor pullbacks. The asset reached an all-time high above $4,900 last month, fueled by growing adoption in traditional finance.

SharpLink Gaming Explores Staking $3.6B Ethereum Treasury on Linea

SharpLink Gaming is evaluating staking a portion of its $3.6 billion Ethereum holdings on Linea, Consensys' Ethereum layer-2 network, following its mainnet launch on September 10. CEO Joseph Chalom confirmed the treasury currently stakes nearly all its ETH through custodians Anchorage and Coinbase but seeks higher-yield opportunities via diversification.

The firm joined the Linea Consortium, a coalition steering the network's growth. "When you hold billions in ETH, deploying through Linea's staking opportunities becomes strategic," Chalom noted, emphasizing alignment with Consensys' vision.

Ethereum (ETH): The Smart Contract Blockchain Revolutionizing Digital Finance

Ethereum has redefined the blockchain landscape since its 2015 launch, introducing smart contracts, decentralized applications (dapps), and non-fungible tokens (NFTs). The platform, conceived by Vitalik Buterin in 2013, enables programmable code execution on its blockchain, fostering innovations like decentralized finance (DeFi) and digital art markets.

The 2022 Merge marked a pivotal shift in Ethereum's evolution, transitioning to a proof-of-stake consensus mechanism. Yet challenges persist—high transaction fees, scalability constraints, and intensifying competition from rival blockchains threaten its dominance. Despite these hurdles, Ethereum remains the backbone of Web3, a decentralized vision of the internet free from corporate control.

As the second-largest cryptocurrency by market capitalization, Ethereum's native token ETH powers this ecosystem. Its potential to underpin a new internet infrastructure continues to attract developers and investors alike, though the network must overcome its technical limitations to maintain leadership in the smart contract arena.

From 1 ETH to 30 ETH—Why Ozak AI Presale Could Deliver a Massive Flip

Ozak AI's presale is gaining traction as one of the most explosive opportunities in the crypto market, drawing interest from both retail and institutional investors. Priced at $0.01 per token, the project has already raised over $2.5 million and sold more than 830 million tokens in its fifth presale stage.

The project's appeal lies in its fusion of artificial intelligence and blockchain technology, aiming to revolutionize crypto market predictions. Analysts speculate that an initial investment of 1 ETH could potentially grow to 30 ETH once the token lists on major exchanges.

Unlike meme coins that rely solely on hype, Ozak AI combines community-driven momentum with tangible utility. Its infrastructure is anchored by the Ozak Stream Network (OSN), a decentralized platform designed to enhance trading decisions through data-driven insights.

ETH Price Poised for Rally as Exchange Flux Balance Turns Negative

Ethereum's price shows resilience despite failing to breach the $4,800 resistance twice, maintaining higher lows that reinforce its bullish structure. The cryptocurrency briefly touched $4,957 before consolidating above $4,200, a critical support level.

For the first time in history, Ethereum's Exchange Flux Balance has turned negative, signaling unprecedented accumulation as investors withdraw ETH from exchanges en masse. This on-chain metric suggests growing confidence in long-term appreciation.

Technical indicators remain favorable, with price action holding above the 20-day EMA while the 7-day EMA crosses bullishly above it. A decisive break past $4,500 could catalyze a retest of the $5,000 threshold.

Hackers Exploit Ethereum Smart Contracts to Conceal Malware in Novel Attack Vector

Cybersecurity researchers at ReversingLabs have uncovered an innovative malware distribution technique leveraging Ethereum smart contracts. The attack, discovered in NPM libraries 'colortoolsv2' and 'mimelib2', marks a significant evolution in blockchain-based cyber threats.

Attackers are now using smart contracts as intermediaries to hide command-and-control URLs, bypassing traditional security scans. Instead of hosting malware directly, the compromised packages retrieve secondary payloads via blockchain transactions—a method that masks malicious traffic as legitimate Ethereum network activity.

Lucija Valentić of ReversingLabs notes this represents a strategic shift. Where hackers previously embedded payloads directly in packages or external servers, the blockchain intermediary creates new detection challenges. The technique specifically targets developers through seemingly benign open-source tools.

BNB Chain Unveils BSC Reth Client to Enhance Network Performance

BNB Chain has launched the alpha version of its BSC Reth client, a significant upgrade designed to optimize node operations and scalability. Built on Paradigm's Reth framework, the new client leverages Rust-based architecture to deliver faster processing and reduced overhead.

Initial benchmarks show a 40% improvement in synchronization speed compared to the existing BSC Geth client. The implementation features Parallel Sparse Trie and ASM Hash optimizations, targeting a long-term throughput goal of 1G gas/s with 750ms block times. These enhancements promise to streamline node operations while maintaining network efficiency.

How High Will ETH Price Go?

Based on current technical indicators and market developments, ETH shows potential for significant upward movement. The negative exchange flux balance indicates reduced selling pressure, while whale accumulation and institutional adoption provide strong fundamental support. Key resistance levels to watch include the 20-day MA at $4,430 and the Bollinger upper band at $4,808. A break above these could target the $5,000-$5,200 range in the coming weeks.

| Key Levels | Price (USDT) | Significance |

|---|---|---|

| Current Price | 4,296.15 | Consolidation zone |

| 20-day MA | 4,430.93 | Immediate resistance |

| Bollinger Upper | 4,808.12 | Breakout target |

| Support Level | 4,053.74 | Key downside protection |